Court Denies Fannie Mae’s Motion to Dismiss in Fair Housing Discrimination Lawsuit

For Immediate Release

August 13, 2019

Contact: Morgan Williams | (202) 898-1661 | mwilliams@nationalfairhousing.org

Late Monday, August 12, 2019, the U.S. District Court for the Northern District of California largely DENIED Fannie Mae’s Motion to Dismiss a fair housing lawsuit concerning housing discrimination against communities of color. The lawsuit, brought by the National Fair Housing Alliance (NFHA) and 20 local fair housing organizations, charged Fannie Mae with failing to maintain foreclosed properties (also known as Real Estate Owned or “REO” properties) in Black and LatinX neighborhoods, even as Fannie Mae simultaneously was keeping foreclosed properties in predominately White communities well-maintained. The fair housing groups allege that Fannie Mae’s poor and improper maintenance policies and practices in Black and LatinX communities contributed to blight and other challenges in these areas.

In a March, 2018 decision, the federal court found that the fair housing groups had standing to bring a lawsuit against Fannie Mae and upheld their disparate impact claims against the mortgage giant. Disparate impact is a longstanding protection that allows people to challenge unjustified policies that might seem neutral on their face but result in discriminatory outcomes. In doing so, the court found that the fair housing groups properly brought the lawsuit alleging that Fannie Mae’s REO maintenance practices unnecessarily discriminated against communities of color, regardless of what the company’s intent might have been.

In Monday’s ruling the court again upheld plaintiffs’ allegations of intentional discrimination. But the court also pointed to the fair housing groups’ assertions that even though they repeatedly warned Fannie Mae that its policies and practices were causing discriminatory outcomes, the company did not change its behavior. The court noted that “…there are sufficient allegations to establish a claim for disparate impact…and the court finds that the Plaintiffs have set out sufficient allegations of intentional conduct.”

“This decision proves that our courts matter when it comes to fighting illegal discrimination,” said Lisa Rice, President & CEO of the National Fair Housing Alliance. She continued, “Communities of color were the canaries in the coal mine when it came to redlining and predatory lending practices that contributed to the foreclosure and financial crises. These same communities that were targeted for unsustainable mortgages were the hardest hit. Fannie Mae’s practices have contributed to the blighted conditions of Black and LatinX neighborhoods and made it harder for these communities, ten years later, to recover from the crisis.”

“We are quite pleased with the court’s ruling which paves the way for the fair housing groups to continue with our lawsuit against Fannie Mae on both disparate impact and intentional discrimination or disparate treatment claims,” said Morgan Williams, General Counsel of the National Fair Housing Alliance. “For centuries, lending institutions have behaved in ways that discriminate against communities of color. It’s difficult to get that hard-wired bias out of our lending DNA. It’s easier to default to practices that manifest discriminatory outcomes. Our goal with this lawsuit is to get the industry moving in another direction. We will never see change if we don’t make change.”

The National Fair Housing Alliance and other local fair housing groups have similar lawsuits pending against Deutsche Bank and Bank of America.

The fair housing groups are represented by Relman, Dane and Colfax, one of the nation’s leading civil rights law firms. The groups are also represented by Morgan Williams, General Counsel of the National Fair Housing Alliance, and Casey Epp, Supervising Attorney of Fair Housing Advocates of Northern California.

Background

On December 5, 2016, the National Fair Housing Alliance along with 20 local fair housing organizations throughout the United States filed a federal lawsuit against Fannie Mae in federal district court in San Francisco, California. The lawsuit alleged that Fannie Mae failed to maintain its foreclosed properties (REO properties) in Black and LatinX neighborhoods to the same level of quality and standards as it did for foreclosed properties it owned in predominately White communities.

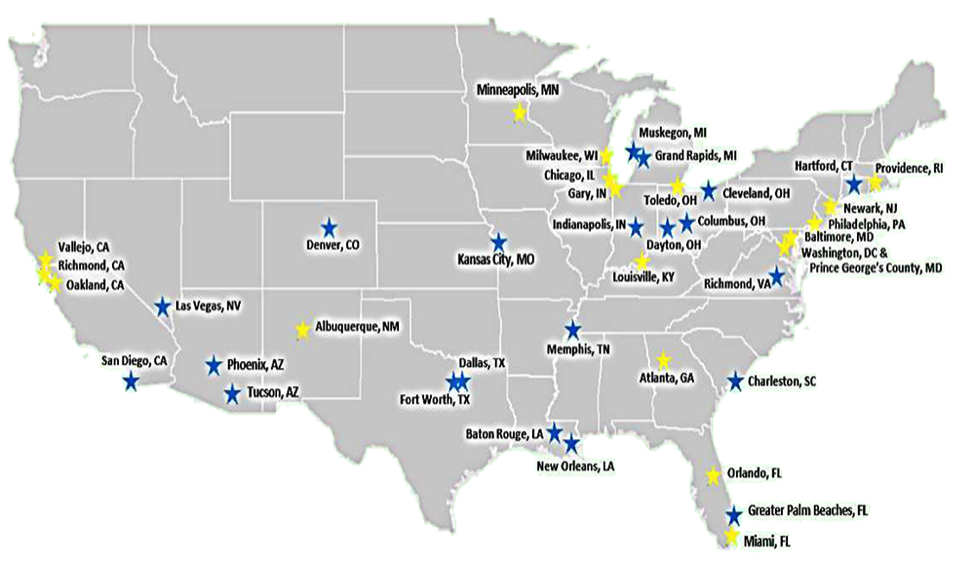

The plaintiff fair housing groups conducted a comprehensive multi-year investigation of over 2,300 properties owned by Fannie Mae in 38 metropolitan areas (see map below) and accumulated over 49,000 photographs documenting the mistreatment and poor maintenance conditions in communities of color as well as the superior treatment and proper maintenance of REOs in predominately White communities. The investigation revealed that Fannie Mae failed to perform routine maintenance, marketing and management activities such as mowing the lawn, trimming hedges, removing debris, maintaining gutters, etc.

NFHA notified Fannie Mae many times of the company’s failure to maintain and market its foreclosed homes in communities of color to the same standard to which it was maintaining and marketing foreclosed homes it owned in similar, predominantly White neighborhoods. In spite of numerous meetings between NFHA and Fannie Mae to address these disparities, Fannie Mae persisted in its willful neglect of REO properties it owned in Black and LatinX neighborhoods.

Resources