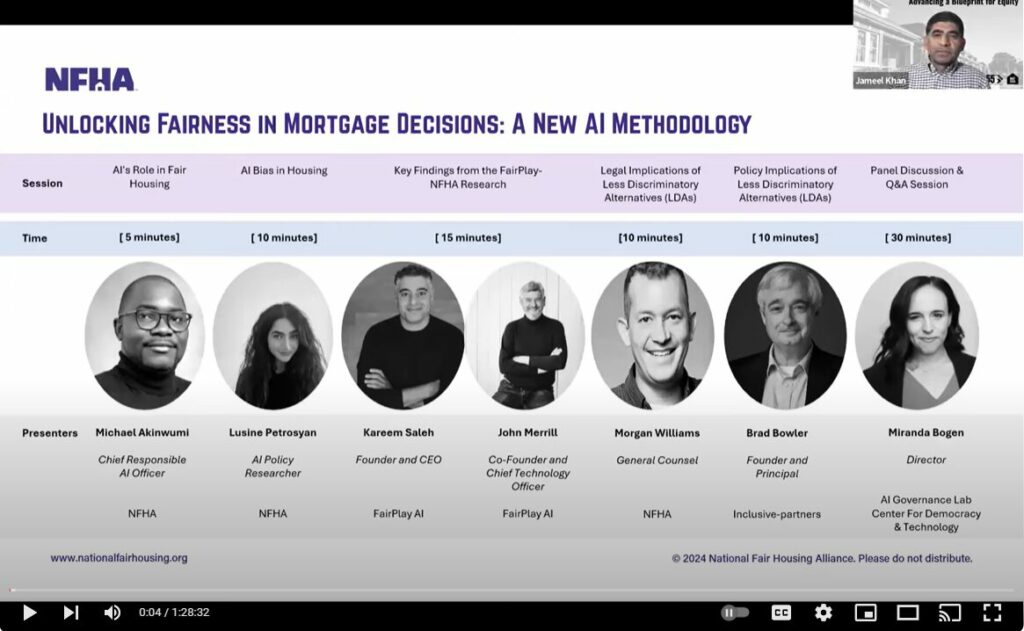

Unlocking Fairness in Mortgage Decisions: An AI Breakthrough

“Improving Mortgage Underwriting and Pricing Outcomes for Protected Classes Through Distribution Matching” — A Joint Study by the National Fair Housing Alliance and FairPlay AI

Download the Report

Click HereMortgage underwriting disparities for historically underserved groups remain essentially unchanged despite several decades of legislative and policy interventions to improve them. Now with artificial intelligence, including machine learning, poised to augment or take over decision making across a range of domains, including in housing and lending, many mortgage market participants and stakeholders are focused on the question of whether algorithmic systems will create, exacerbate, or ameliorate disparities for protected groups. One potentially positive development in recent years is the emergence of algorithmic fairness techniques which aim to do a better job of predicting outcomes for populations that are not well-represented in data and/or negatively impacted by historical biases that might be contained in data used to develop models. This study evaluates whether there are algorithmic methods — using standard machine learning training techniques — that make it possible to build mortgage underwriting and pricing models that increase fairness without sacrificing accuracy and, by extension, without sacrificing profitability or introducing a bias for certain groups. Read more.