Washington State’s Covenant Homeownership Act Program

A historic effort to address the role of government institutions in housing-related discrimination

Read the Newly Released Study

click here

In May 2023, Washington Governor Jay Inslee signed into law the Covenants Homeownership Act (Act). The landmark law called for a research study to document any complicity of government institutions in racial housing discrimination as well as the impacts of such discrimination on homeownership access. The Act also required the study to analyze how well race-neutral approaches to expanding homeownership opportunities might overcome or remedy any identified harm and whether legally designed Special Purpose Credit Programs are necessary to fulfill the task. If the study revealed the government played a role in supporting discrimination, it would also determine who could be eligible for homebuyer assistance programs to reduce racial homeownership disparities in the state.

The National Fair Housing Alliance is proud to have been selected along with Abt Associates, the Fair Housing Center of Washington and the Northwest Fair Housing Alliance to complete the study, a fundamental step in implementing the law.

The comprehensive study, released in March 2024, and found here uncovered how generations of state-sponsored housing discrimination in Washington state led to the current racial gaps in homeownership. The report extensively documents historical acts of housing discrimination supported by the state government that contributed to racial gaps in homeownership, wealth, housing cost burden, homelessness, access to mortgage lending and appraisal disparities.

KEY FINDINGS:

- Washington residents of color and other marginalized groups faced widespread discriminatory barriers to equal housing opportunities from the 19th century onward, implemented through State and local governmental policies and practices.

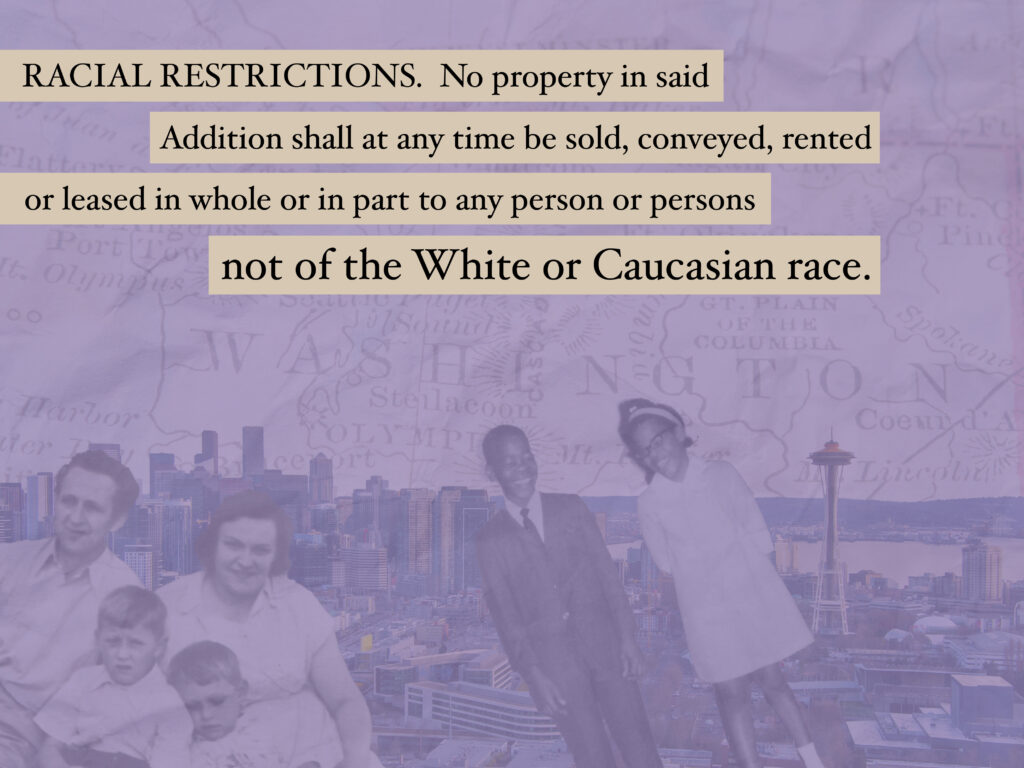

- These discriminatory actions included land seizures, forced removal, over 50,000 racially restrictive covenants barring people of color and other marginalized groups from purchasing homes and living in specific neighborhoods, exclusionary zoning practices, and racist practices in the State-licensed real estate, state-chartered lending, and state-licensed appraisal industries. State courts reinforced many of these practices.

- As a direct result, people of color and other marginalized groups in Washington were prevented from buying homes, accessing credit, and building wealth. These groups experienced widespread segregation and confinement to areas deemed least desirable by public officials and private actors. Residential segregation patterns established at this time persist to varying degrees today.

You can learn more about the study’s findings by visiting https://www.wshfc.org/covenant/ for more in-depth information.

Click below to watch a 10-minute presentation on the Covenant Homeownership Act.

Homeownership is key to financial stability and many other opportunities. At the National Fair Housing Alliance, we know that where you live matters, whether it’s access to credit or the Internet, quality health care and education, or even healthy food options. Unfortunately, the Black/White and Latino/White homeownership gaps today are as big as it was before passage of the Fair Housing Act in 1968.

In Washington state, like in many other parts of the country, discriminatory real estate covenants were present until the 1960s, leading to the lingering homeownership barriers that minorities face. Researchers from the University of Washington found more than 40,000 examples within the state of racist neighborhood covenants that excluded people of color.

Covenants like this haven’t been in effect since 1969, but they’ve still been poisoning us since the day they were written. This bill is doing the right thing.

Governor Jay Inslee of Washington State

The result of these racist covenants is evidenced in lagging homeownership and wealth gaps. White homeownership in the state was 67 percent in 2019 while Black homeownership was only 31 percent. Latino homeownership in the state during the same period was 45 percent.